Real Estate Company Going Public Via Spac

Accor is the latest company to dive into the special purpose acquisition company or SPAC merger market. A 30 million raise pre-SPAC The companys headquarters near the San Francisco Bay in.

Special Purpose Acquisition Company Spac Overview How It Works

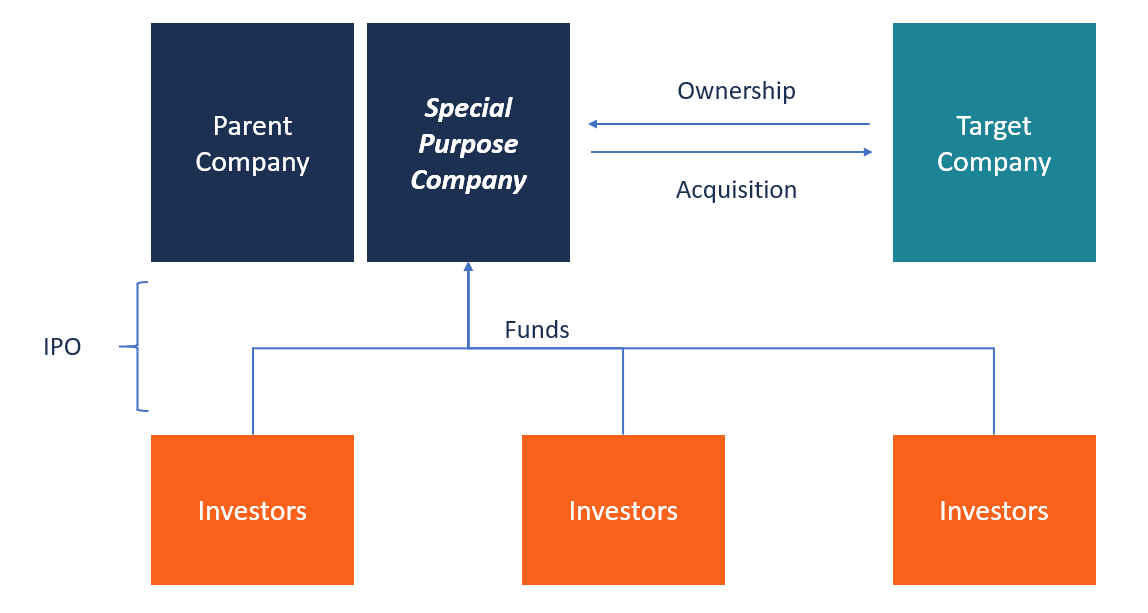

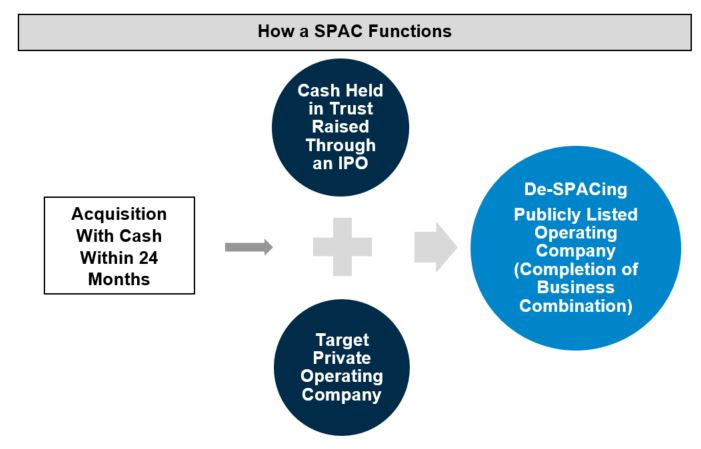

A SPAC is a shell company that lists on a stock exchange with the intention of merging with a private firm to take it public.

Real estate company going public via spac. The company is going public via a reverse merger with Virgin Groups VG Acquisition Corp NYSEVGAC a special purpose acquisition company. The company is targeting a 15 billion valuation upon combining with. The companys real value is in its trove of genetic data which isnt going anywhere.

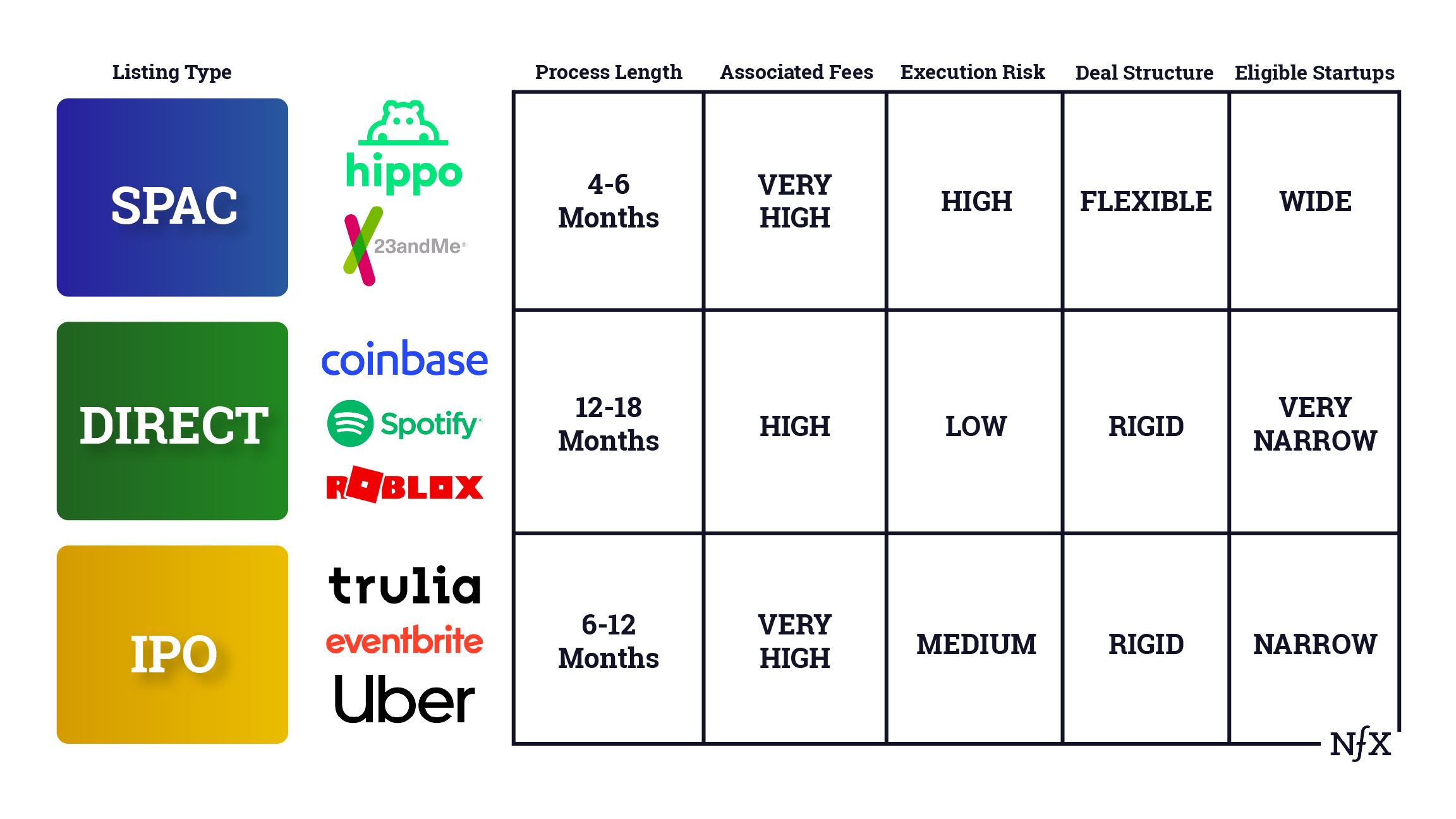

Innovid a 14-year-old ad tech company focused on connected television plans to go public via a merger with a publicly traded special purpose acquisition company. Heres What You Need to Know. Second going public via SPAC can provide a huge amount of growth capital for the company being acquired.

Since the SPAC is already a public company the regulatory requirements are much easier than if the target company had decided to do its own IPO. Blade Urban Air Mobility the New York-based helicopter taxi service has struck a deal to go public via a sale to a blank-check company backed by. Thrasio rumored to go public via SPAC.

The company has now raised nearly 390 million and PitchBook data. Topps announced Tuesday plans to merge with a special purpose acquisition company or SPAC in a. Acorns going public via SPAC.

The process can happen quickly and without costly and complicated steps like an IPO roadshow. The deal implies a. CCV a SPAC led by Michael Klein per Bloomberg.

Sohini Podder d2181. Thrasio an Amazon third-party aggregator was reported to be in talks to go public via a merger with special purpose acquisition company Churchill Capital V Corp according to Bloomberg which cited people with knowledge of the matter. Online grocery retailer Boxed to go public via 900 million SPAC deal Lauren Feiner CNBC.

The private company then gets the SPACs place in the stock market. Startup mortgage lender Better HoldCo is going public via a merger with special purpose acquisition corporation SPAC Auroa Acquisition Corp. Acorns a provider of savings and investment accounts is the latest venture-backed company to announced plans to go public through a merger with a blank-check acquirer.

23andMe Is Going Public Via a SPAC. The Irvine California-based company has inked a deal with Pioneer Merger Corp a publicly traded special purpose acquisition company or SPAC. Blade lands a SPAC.

Richard Bransons Virgin Galactic also went public through a deal with Chamath Palihapitiyas SPAC in 2019. Thrasio a Walpole Mass-based acquirer of Amazon third-party private-label businesses is in talks to go public via Churchill Capital V NYSE. Acorns the investment app that allows users to invest spare change from daily transactions is going public.

More than 400M to be plowed back into the business for growth. German-based competitor Volocopter which is still a private company has also recently been rumored to go public via a SPAC. The fintech company will merge with a SPAC.

The health tech startup in Boston and Lexington is the latest Massachusetts-based company to make the call to go public through a deal with a special purpose acquisition company or SPAC. 83-year-old baseball card company Topps is going public. Business Finance LogisticsSupply Chains Modern Shipper News Top Stories Warehouse NextNav with its warehouse-ready positioning technology going public via SPAC Spartacus will acquire the company in a valuation of more than 1B.

The Real Deal is tracking real estate firms that are joining the SPAC or blank-check company craze to take proptech companies public. BuzzFeed said Thursday it plans to go public via a special purpose acquisition company SPAC. Gaming platform public via SPAC at a.

23andMe raised approximately 592 million in gross. Going to be more of a real estate SPAC. Blink and youll miss a new SPAC.

The implied valuation could top 10 billionWhy it matters. In total its database has the genomes of. This comes just days after Congress introduced a bipartisan bill that would break apart Amazons control of its marketplace thus.

In a letter to SEC chair Alphabet Amazon Facebook Intel and others urge SEC to require mandatory disclosures on climate-related matters to shareholders.

Key Considerations For Target Companies In A Spac Merger Thompson Coburn Llp Jdsupra

Taking A Data Center Company Public Through A Spac What To Know Data Center Knowledge

The New World Of Going Public Pros Cons Of Ipo V Spac V Direct Listing

What Is A Spac Ipo Definition And Examples

Spac Special Purpose Acquisition Companies Spac

The Netflix Of Financial Content Is Going Public Via A Spac Barron S

Beware The Spac How They Work And Why They Are Bad Seeking Alpha

Spacs And Direct Listings Are Reshaping The Capital Markets

Ipos Spac Calendar 2021 Among Some Of The Most Expected By Bogdan Florin Ceobanu Medium

Spac Investments Reverse Mergers Key Things You Need To Know In 2021 The Washington Independent

Is Going Public Through A Spac Merger Truly Cheaper Than Ipos Or Direct Listings

Going Public With Spacs Bosinvest

Spac And Traditional Ipo Executive Compensation Considerations When Going Public Alvarez Marsal Management Consulting Professional Services

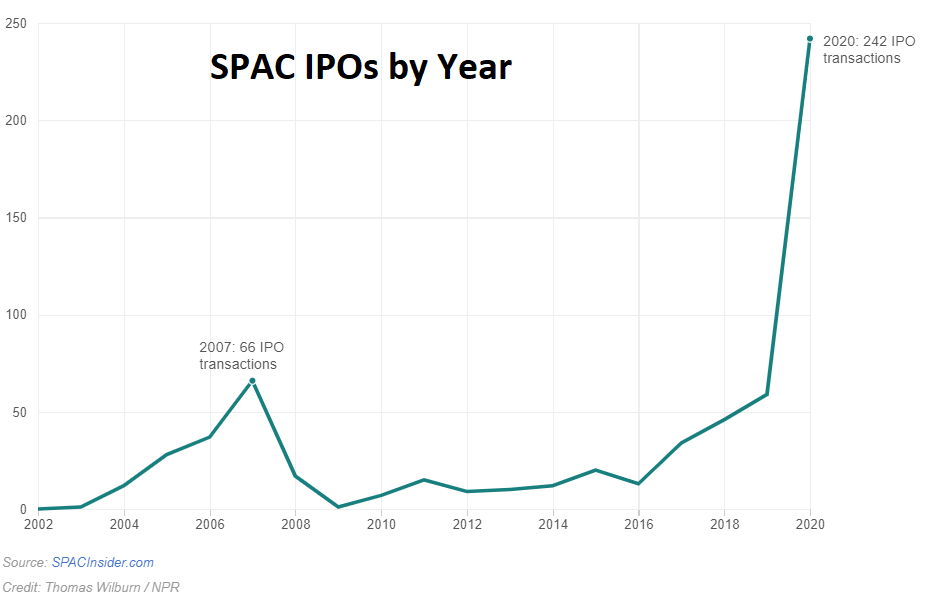

Once Derided Special Purpose Acquisition Companies Go Mainstream Amid Turbulent Markets The Real Economy Blog

Spacs And The Evolution Of Companies Going Public

10 Spac Ipo Stocks To Buy As They Grow In Popularity Investorplace

Spac An Alternate Route For Companies Going Public

Comments

Post a Comment