Mortgages For Bad Credit In Ny

Note that if you dont pay your rent the landlord will ask your co-signer to do so so make sure you ask someone you trust who also trusts you. Although personal loans can technically be used for whatever you like some uses are simply a bad idea.

500 Credit Score Mortgage Lenders Great Options

Consumers in search of bad credit home loans may be surprised to discover they have multiple options.

Mortgages for bad credit in ny. There are 75 affiliated City National offices throughout the US and the company and its subsidiaries have assets of more than 36 billion. 8 tips for first-time homebuyers with bad credit. Mortgages Bad-Low Credit NEW REFI MORTGAGES Best Rates in Alaska Best Rates in Alabama Best Rates in Arizona Best Rates in California.

Reverse mortgages allow homeowners age 62 and older to access their home equity to generate income in older age. A conventional mortgage is the standard home loan. At the top of the bad-idea list is using a personal loan to purchase a home or vehicle.

While a reverse mortgage may be ideal for some situations it is not always best. If you can get someone with good credit to co-sign for you the landlord might agree to rent you that apartment. If nothing else works call in some backup to help you rent with bad credit.

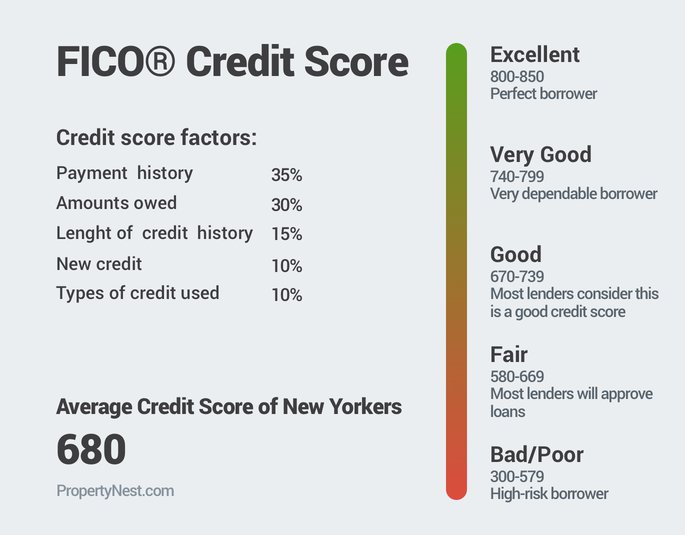

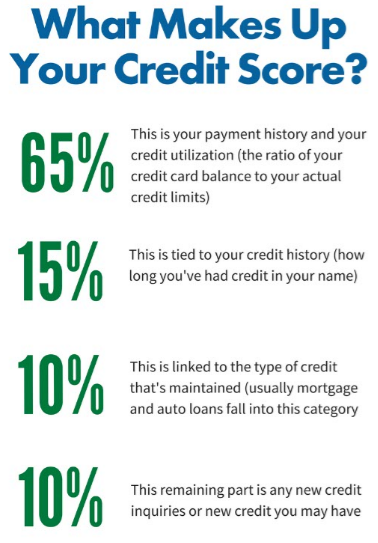

While homebuyers with excellent credit qualify for mortgages with the most favorable terms there are several programs and loans available for prospective homeowners buying a home with bad credit. We help you navigate SONYMA programs. New York conventional mortgages.

The State of New York Mortgage Agency offers special programs to qualified first-time home buyers who want to purchase property in-state in 2019. These include mortgages vehicles and business assets. These include mechanic and tax liens.

If your credit score is at least 620 and your debt-to-income ratio is 45 percent or less youll likely. New York City Nashville and Atlanta. Because personal loans particularly those for consumers with poor credit will have significantly higher interest rates than either auto or home loans with personal loan APRs typically exceeding.

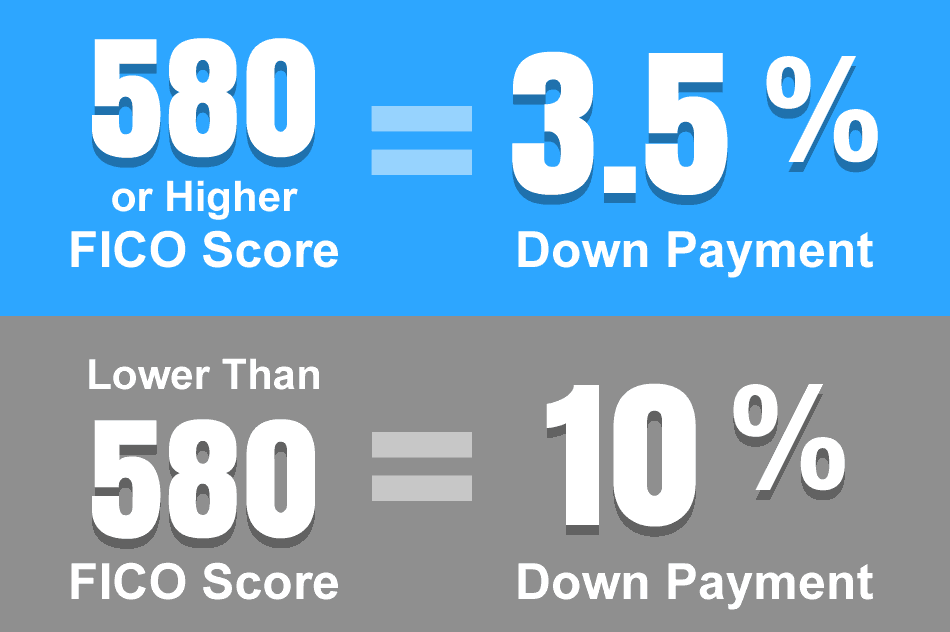

Statutory liens are considered the bad kind and can will remain listed on your credit for seven years. First-time homebuyers with bad credit or FICO scores below 580 often face more challenges than buyers with good or excellent credit but there are steps that may help demonstrate your creditworthiness. Home loans for bad-credit first-time buyers What to expect when buying a home with bad credit.

Mortgage Calculator Excel 9 Mortgage Payoff Calculator Calculate The Mortgage Loan Calculator Mortgage Amortization Calculator Mortgage Payment Calculator

How To Get A Mortgage With Bad Credit Credit Com

What Does Anually Mean How To Memorize Things Synonyms And Antonyms Words

From All Of Us At Artisan Mortgage We Hope You Have A Wonderful Holiday Season We Look Forward To Making The Dre Mortgage Brokers Mortgage Mortgage Companies

6 Steps To Homeownership Home Ownership Home Buying Process Home Buying

Closing Disclosure Page 2 Mortgage Mortgage Calculator Mortgage Rates

Rushing To Refinance Your Mortgage 6 Tips And What To Avoid Published 2020 Mortgage Refinance Mortgage The Borrowers

What Is The Minimum Credit Score I Need To Qualify For A Kentucky Fha Va Usda And Khc Conventional Mortgage Loan Mortgage Loans Conventional Mortgage Fha

How To Get A Mortgage With Bad Credit Debt Org

Outlandish Mortgages Expensive Houses Real Estate Infographic Buying Property

Buying Home In Kenya For First Time First Time Home Buyers Buying Your First Home Real Estate Buyers

How To Get A Home Loan With Bad Credit In New York Propertynest

Does Shopping Around For A Mortgage Hurt Your Credit Score

How To Get A Bad Credit Home Loan Lendingtree

How To Get A Mortgage With Bad Credit Credit Com

Pin By Allissaadellefionnaie On Mortgage In 2020 Loans For Bad Credit Mortgage Debt Consolidation Loans

Minimum Credit Scores For Fha Loans

Comments

Post a Comment